- Analiz

- Piyasa Haberleri

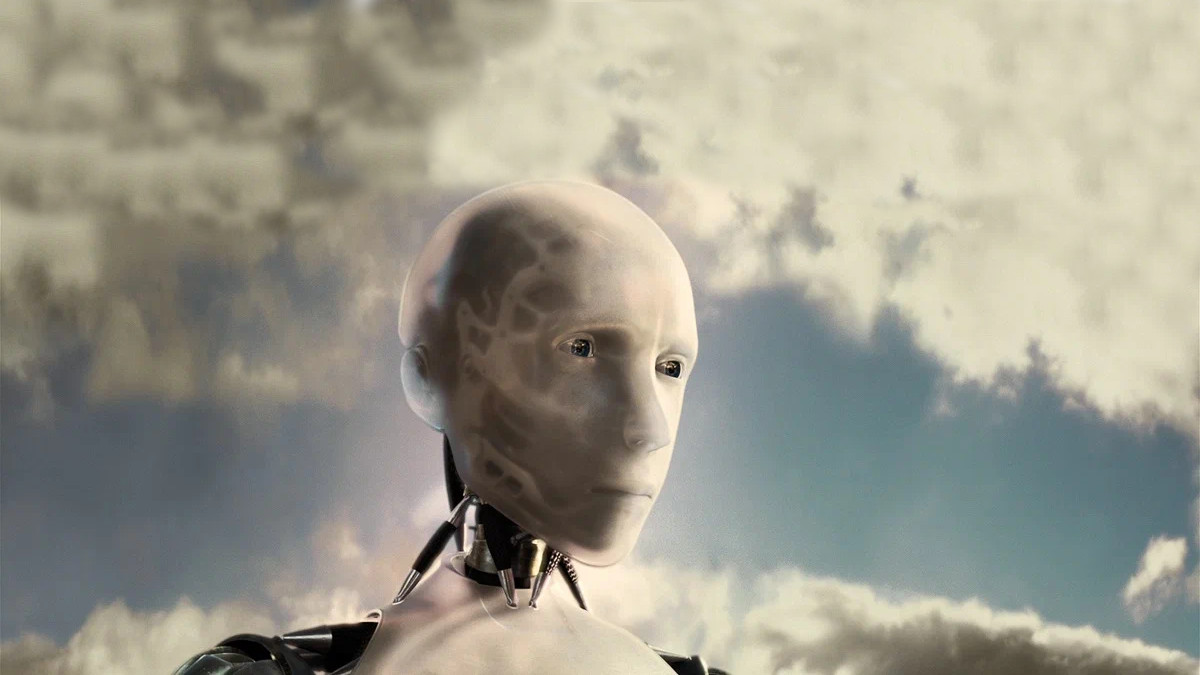

- Tech Giants Invest Billions in AI for Long-Term Growth

Tech Giants Invest Billions in AI for Long-Term Growth

Tech giants are ramping up AI investments, signaling a serious commitment to an AI-driven future. Microsoft, Google (Alphabet), Meta Platforms, and Amazon are spending tens of billions on data centers and cloud computing, with plans for even higher spending in 2025.

Key Takeaways

- Microsoft, Google, and Meta: Combined capital expenditures are projected to hit at least $215 billion this fiscal year, a more than 45% annual increase.

- Amazon: Overall capital spending is expected to exceed $100 billion, largely driven by AI initiatives.

This increased spending reflects a belief that AI will fundamentally change applications and services across industries.

Company Analysis

Amazon

Amazon booked a record $26 billion in capital expenditures in Q4 2024. Despite missing sales expectations and a 4% drop in after-hours trading, the long-term outlook remains positive.

Short-term price adjustments could provide entry points ahead of a potential expansion in its AI-driven cloud services.

Google (Alphabet)

Spending is set to rise from $52.5 billion in 2024 to about $75 billion in 2025. Shares fell roughly 7% after weak cloud revenue, but CEO Sundar Pichai highlighted cost reductions and increased AI adoption.

Current undervaluation may offer a buying opportunity if market skepticism eases with improved revenue growth.

Microsoft

Committed to investing $80 billion in AI data centers this fiscal year. A 6% stock decline followed disappointing cloud growth figures, though CEO Satya Nadella expects exponential demand as AI technology matures.

Short-term volatility may hide strong long-term fundamentals.

Meta Platforms

Forecasting capital expenditures between $60 billion and $65 billion this year, up roughly 70%. Shares increased by about 5% since the last earnings report, indicating growing market confidence despite concerns over profitability margins and revenue growth timelines.

High spending could pressure margins, but the commitment signals a strong strategic push into AI.

Conclusions for Traders

1. Long-Term Growth vs. Short-Term Volatility

AI capex (capital expenditure) is a strong long-term growth signal for tech, but expect short-term earnings and margins to suffer as companies burn cash. Volatility is on the way.

2. Valuation Opportunities

Tech giants’ shares are down despite strong future projections, potentially offering value entry points. Overreactions to quarterly reports might be your way in.

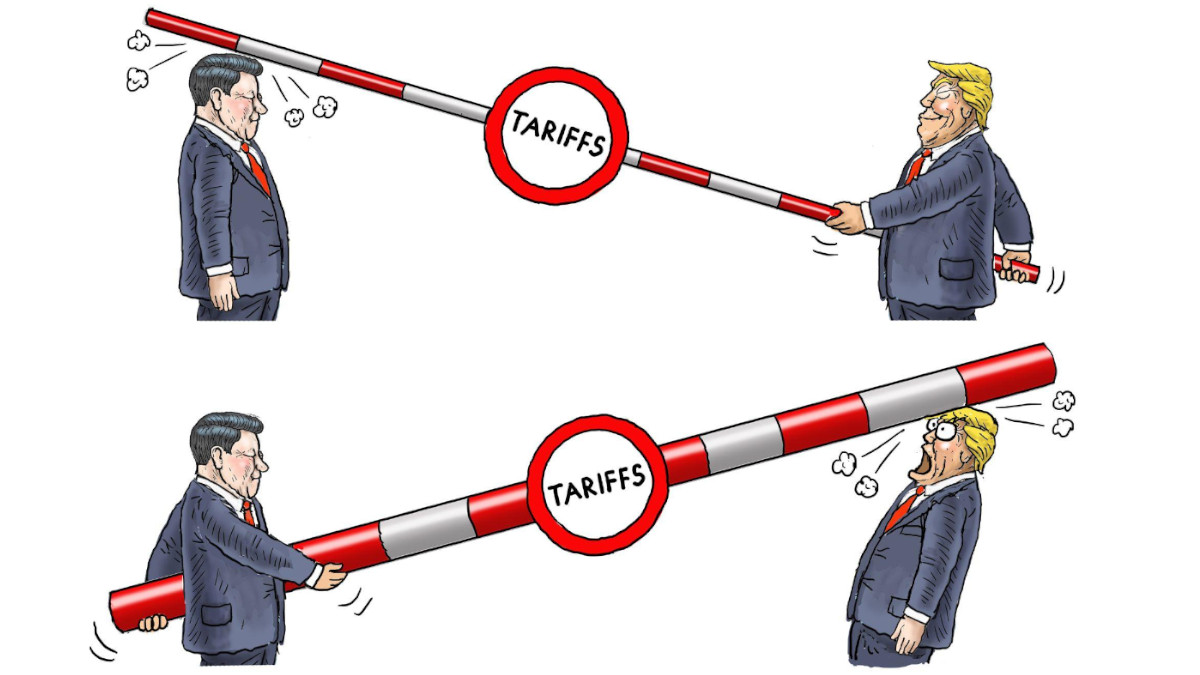

3. Competitive Landscape and Risks

New entrants like China’s DeepSeek claim to deliver top-tier AI at lower costs. U.S. firms are confident, but rising global competition could erode margins.

4. Sector Rotation and Diversification

Not every tech stock will win in the AI race. Spread your bets across companies with solid cloud revenue, R and D, and monetization capabilities.

Conclusion

Tech giants are pouring billions into AI infrastructure. Microsoft, Google, Meta, and Amazon are ramping up spending to drive long-term growth, even if short-term earnings and stock prices face volatility. The focus is clear: invest heavily now to secure future market leadership as AI transforms every facet of tech.