- Analiz

- Teknik analiz

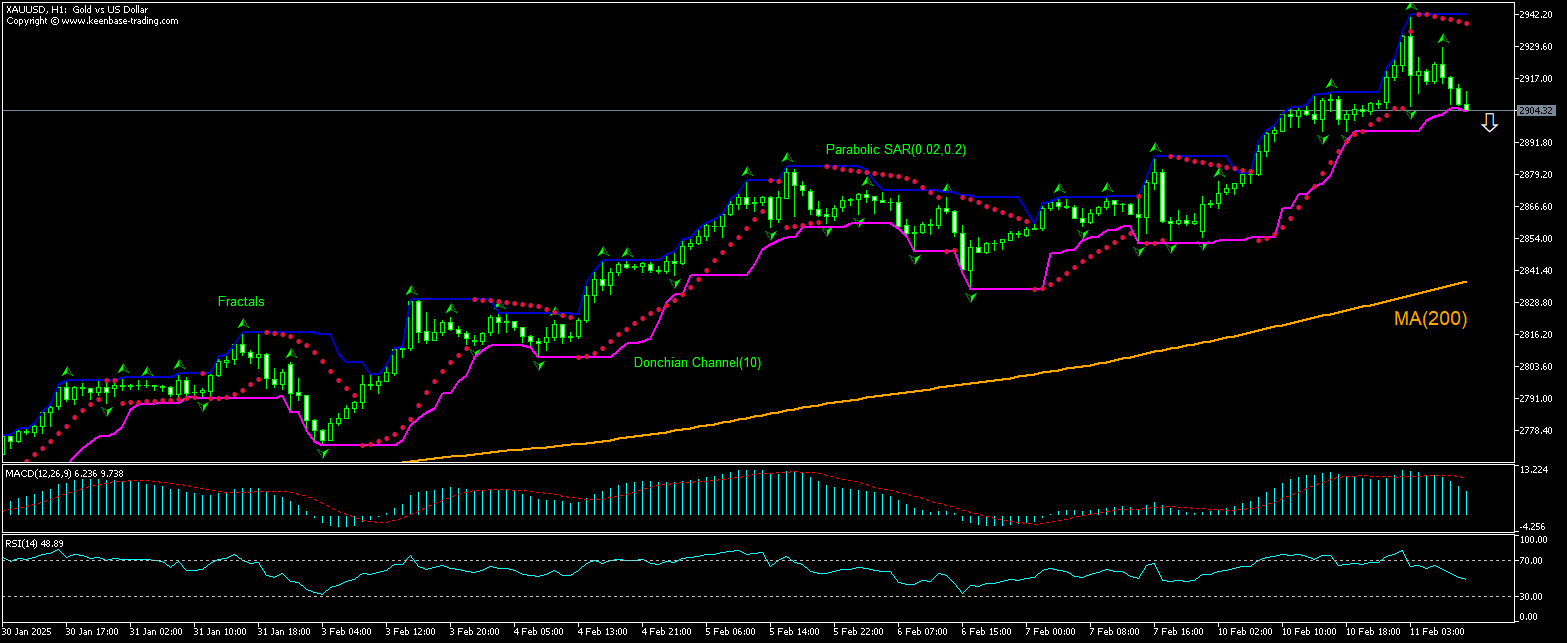

Altın Teknik Analiz - Altın Ticaret: 2025-02-11

Altın Teknik Analiz Özeti

Below 2901.81

Sell Stop

Above 2929.14

Stop Loss

| Gösterge | Sinyal |

| RSI | Nötr |

| MACD | Sat |

| Donchian Channel | Sat |

| MA(200) | AL |

| Fractals | Sat |

| Parabolic SAR | Sat |

Altın Grafik analizi

Altın Teknik analiz

The technical analysis of the XAUUSD price chart in 1-hour timeframe shows the XAUUSD, H1 is retracing lower above the 200-period moving average MA(200) after hitting all-time high today. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 2901.81. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper Donchian boundary at 2929.14. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals . Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (2929.14) without reaching the order (2901.81), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Temel analiz Değerli Metaller - Altın

Gold is retracing lower after renewed advance following University of Michigan data indicating elevated US inflation expectations. Will the XAUUSD price retreat continue?

University of Michigan’s consumer survey showed US inflation expectation rose by 20 basis points over month in December. At the same time respondents expect the inflation rate a year from now to be 4.3%, a 1 percentage point jump from January and the highest level since November 2023. Analysts note that the near- term inflation expectations were boosted by anticipation of price increases consumers see coming after imposition of tariffs on US trading partners. While president Trump postponed tariffs against Canada and Mexico, 10 percent tariffs were introduced for Chinese imports which prompted China’s retaliatory tariffs. Yesterday president Donald Trump signed an executive order imposing 25% tariffs on steel and aluminum imports "without exceptions or exemptions." He also announced plans to introduce reciprocal tariffs on other countries in the coming days. US tariffs and retaliatory responses by targeted countries raised concerns about a global trade war that could fuel inflation, potentially limiting the Federal Reserve's ability to cut interest rates further. Expectations of higher US inflation and higher interest rates raises demand for safe haven asset gold. Price of gold resumed rising after the release of University of Michigan consumer sentiment report. However, the price is retreating currently after hitting all-time high today.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.