- Analiz

- Teknik analiz

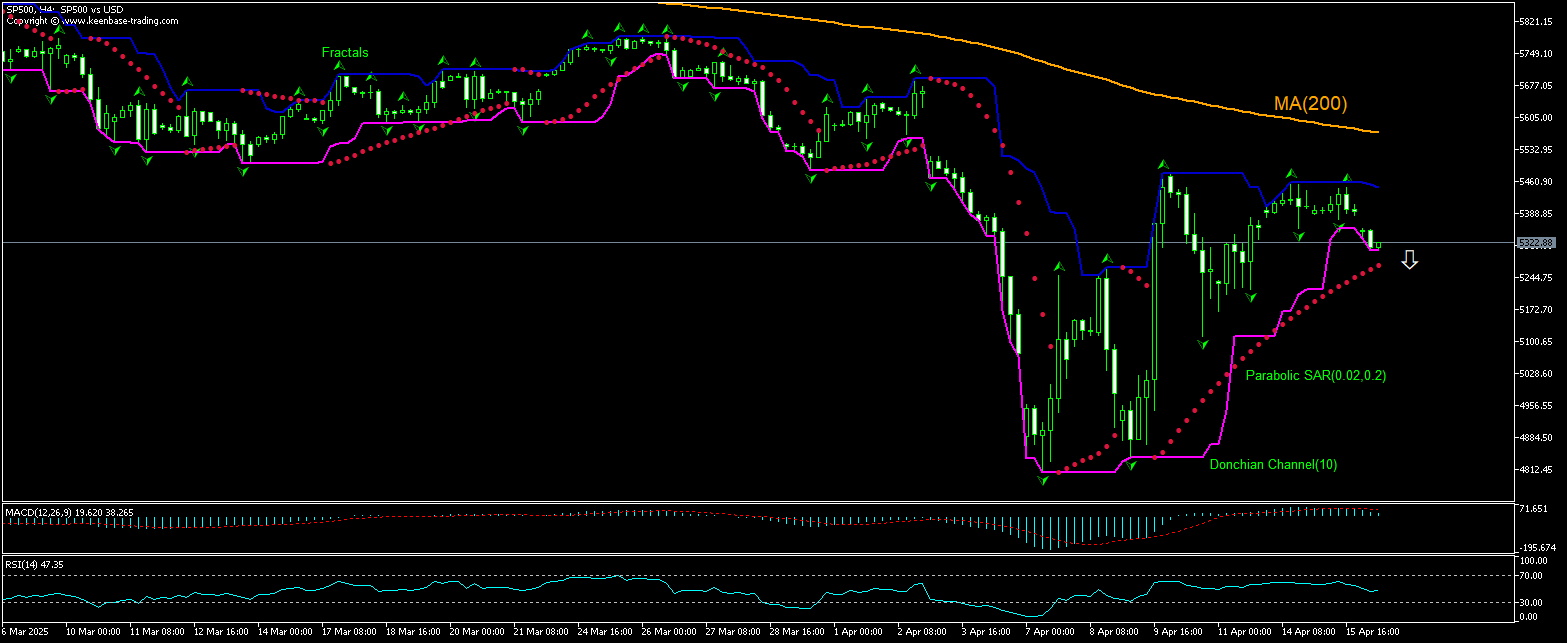

S&P 500 Endeksi Teknik Analiz - S&P 500 Endeksi Ticaret: 2025-04-16

Standard & Poor’s (500), Hisse senedi endeksi Teknik Analiz Özeti

Below 5304.37

Sell Stop

Above 5447.83

Stop Loss

| Gösterge | Sinyal |

| RSI | Nötr |

| MACD | Sat |

| Donchian Channel | Sat |

| MA(200) | Sat |

| Fractals | Sat |

| Parabolic SAR | AL |

Standard & Poor’s (500), Hisse senedi endeksi Grafik analizi

Standard & Poor’s (500), Hisse senedi endeksi Teknik analiz

On SP500 technical analysis of the price chart in 4-hour timeframe reveals the SP500,H4 is retreating under the 200-period moving average MA(200) after rebounding to one-week high two days ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 5304.37. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 5447.83. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (5447.83) without reaching the order (5304.37), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Temel analiz Endeksler - Standard & Poor’s (500), Hisse senedi endeksi

US economic reports were mixed yesterday. Will the SP500 decline continue?

Recent US economic data were mixed. The decline in New York State manufacturing activity slowed while US import prices decreased. According to the Empire State Manufacturing Survey, the Empire State Manufacturing Index rose to -8.1 in April from -20.0 in March when an increase to -12.8 was expected. Readings above 0.0 indicate improving conditions, below 0.0 indicate worsening conditions. The Federal Reserve Bank of New York reported that the business activity declined modestly after steep decline in previous month, while “price increases picked up to the fastest pace in more than two years. Firms turned pessimistic about the outlook for the first time since 2022.” At the same time, the Bureau of Labor Statistics reported US import prices unexpectedly fell while export prices remained unchained. Import prices slipped 0.1% over month in March on lower fuel costs following a downwardly revised 0.2% increase in February when no change was expected. In annual terms, import prices increase slowed to 0.9% over year in March from a 1.6% rise in February. Slower than expected decline in New York State manufacturing activity is bullish for SP500, while declining import prices is bearish for the SP500 index. The current setup is bearish for the SP500.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.