- Analiz

- Piyasa Duyarlılığı

Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Top Gainers – The World Market

Top Gainers – The World Market

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The Japanese yen weakened after the release of negative economic indicators: Balance of Trade, Industrial Production and a number of other indicators of business activity in the industry. Moreover, the yen was negatively affected by Haruhiko Kuroda's (the head of the BoJ) belief that Japanese inflation is unlikely to reach the +2% target by 2024. In January 2021, it was -0.6% in annual terms. Investors believe that the Bank of Japan will continue its soft monetary policy.

1.Shaw Communications Inc, +46,8% – a Canadian telecommunications company

2. Kawasaki Kisen Kaisha, Ltd, +29,6% – a Japanese transport, shipping company

Top Losers – The World Market

Top Losers – The World Market

1. K&S AG – a German potash fertilizer company

2. Tokyo Electric Power Company, Inc. – a Japanese electric company.

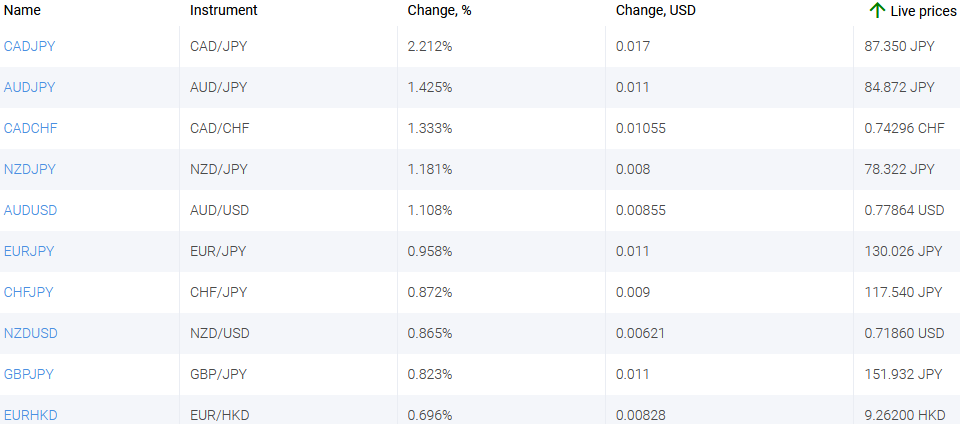

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. CADJPY, CADCHF - the growth of these charts means the strengthening of the Canadian dollar against the Japanese yen and Swiss franc.

2. AUDJPY, NZDJPY - the growth of these charts means the weakening of the Japanese against the Australian and New Zealand dollars.

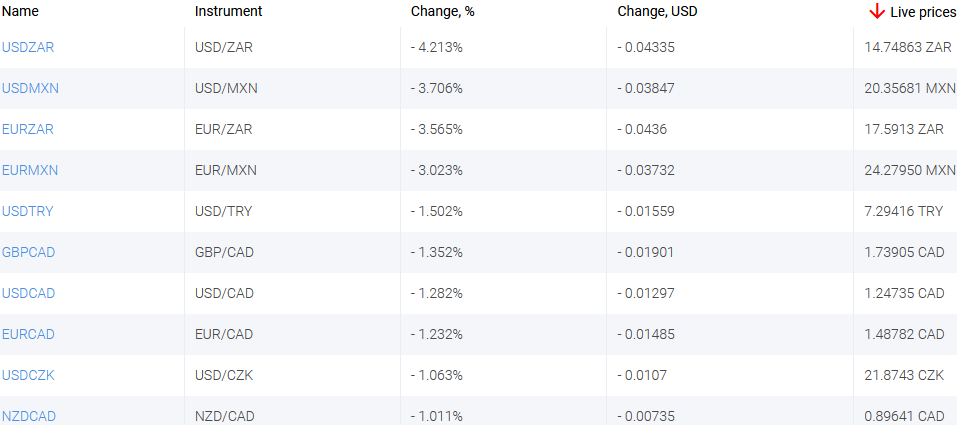

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. USDZAR, EURZAR - the drop of these charts means the weakening of the US dollar and euro against the South African rand.

Yeni Özel Analitik Araç

Herhangi bir tarih aralığı - 1 gün ila 1 yıl arası

Herhangi bir Enstrüman Grubu - Forex, Hisse Senetleri, Endeksler, vs.

Not:

Bu bilgilendirici ve eğitici bir genel bakıştır ve ücretsiz olarak yayımlanmaktadır. Burada yer alan tüm veriler kamu kaynaklarından alınmış ve az çok güvenilir olarak kabul edilmiştir. Aynı zamanda, bilgilerin tam ve doğru olduğuna dair hiçbir garanti yoktur. Gelecekte bunlar güncellenmemektedirler. Görüşler, göstergeler, grafikler ve kalan her şey dahil olmak üzere her genel bakışta olan tüm bilgiler sadece değerlendirme amacıyla sağlanıp mali dalışmanlık veya tavsiye niteliğinde değildirler. Tüm metin ve onun herhangi bir bölümünü veya grafikleri herhangi bir varlıkla işlem yapmak için bir teklif olarak kabul edilemez. IFC Markets şirketi ve şirket çalışanları bu genel bakışın incelenmesi sırasında veya sonrasında başkası tarafından alınan herhangi bir eylem için hiçbir koşulda sorumlu değildir.

Son Piyasa Duyarlılığı

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...

- 25Şub2021Weekly Top Gainers/Losers: New Zealand dollar and Swiss franc

Prices for various goods and raw materials continued to climb over the past 7 days. This led to the strengthening of the commodity currencies: Australia and New Zealand. The yield on US 10-year bonds has been actively growing since early 2021. Within this period it increased from 0.9% to 1.49% per annum,...