- Analytics

- Technical Analysis

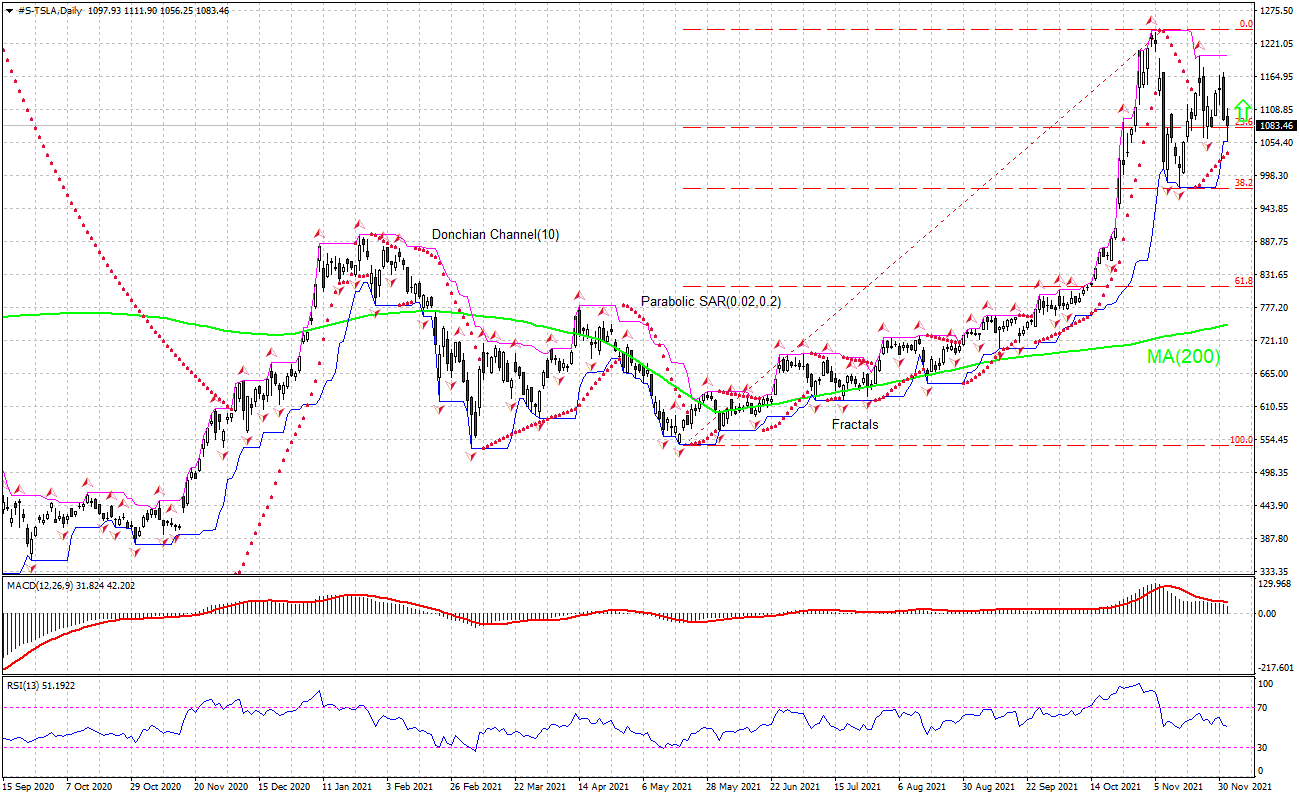

Tesla Technical Analysis - Tesla Trading: 2021-12-03

Tesla Technical Analysis Summary

Above 1201.01

Buy Stop

Below 1056.25

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Tesla Chart Analysis

Tesla Technical Analysis

The technical analysis of the Tesla stock price chart on daily timeframe shows #S-TSLA: Daily is consolidating above the 200-day moving average MA(200) which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 1201.01. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 1056.25. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (1056.25) without reaching the order (1201.01), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Tesla

Tesla didn’t experience supply setbacks in Q3 from chip shortages which caused bottlenecks for its rivals. Tesla stock retreated however as Elon Musk sold another block of company shares worth about $700 million. Will the Tesla stock price continue rebounding?

Tesla’s stock suffered a decline after Elon Musk sold a considerable portion of his holding in mid-November. However, Tesla stock's year-to-date return has reached 50.71% currently. At the same time Tesla has moved to top position in the automotive sales chart in Europe for September. For relative performance comparison with its EV competitors, many of Tesla’s competitors reported weak production in Q3 due to chip supply shortages. Tesla didn’t suffer the disruption from chip shortage due to its ability to modify the software so that different chips could be used instead. And a few days ago Tesla withdrew its application for $1.3 billion in state subsidies support for the construction of a planned battery plant near Berlin, Germany. The decision came on back of heightened demand for electric vehicles in China - it is apparently so strong that Tesla has decided to invest $188 million to expand production capacity at its Shanghai factory. It's so high that Tesla is putting 4,000 more people on the payroll at the site. And as analysts point out, Tesla is making it clear that doesn't really need these subsidies anymore. Over the past 12 months, it has generated free cash flow of $2.6 billion, and profits of $3.5 billion. By forgoing this subsidy, Tesla urges governments to not subsidize rivals such as Rivian, Lucid, and other EV companies that have not yet reached profitability.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.