- Education

- Introduction to Trading

- How to Day Trade in Canada

How to Day Trade in Canada

Day trading differs from other forms of stock trading and investing in that it involves holding securities for only a single day. Engaging in day trading can be risky and stressful, particularly if one is unprepared.

However, day trading in Canada has become much more accessible as there is no longer a need to seek advice from a financial advisor. Nowadays, individuals can purchase and trade stocks through their bank, as well as through numerous online brokerages and apps, which has resulted in a surge of interest in day trading.

KEY TAKEAWAYS

- Day trading is a type of stock trading where an investor buys and sells securities, such as stocks, options, currencies, or futures, within a single trading day.

- Scalping is a day trading strategy where traders make multiple trades within a day, aiming to profit from small price movements.

- Day traders take advantage of the momentum of the market and try to ride the trend as long as possible.

- Traders need to consider their day trading infrastructure, which includes modeling software, computer hardware, and data sources.

What is Day Trading

Day trading is a type of stock trading where an investor buys and sells securities, such as stocks, options, currencies, or futures, within a single trading day. The objective of day trading is to profit from small price movements in the securities being traded, typically leveraging large amounts of capital to maximize gains.

Day traders often use technical analysis and charting tools to identify potential trades and make rapid decisions based on real-time market data. Due to its fast-paced and high-risk nature, day trading requires a significant amount of knowledge, experience, and discipline.

If you are just making your first steps using a real trading account we suggest you read the Day Trading Stocks for Beginners article.

Day Trading Strategies

Day trading is a popular form of trading where traders buy and sell financial instruments within the same day. It can be a high-risk, high-reward strategy, but with the right knowledge and tools, day trading can be a profitable venture. In this article, we'll go over some day trading strategies and provide examples to help beginners get started.

Scalping

Scalping is a day trading strategy where traders make multiple trades within a day, aiming to profit from small price movements. Scalpers hold their trades for a few seconds or minutes, and they use technical analysis to identify entry and exit points.

For example, if a stock is trading at $50 and a scalper thinks it will rise to $51, they'll buy the stock and sell it as soon as it reaches their target price. The profit may be small, but if done consistently, it can add up over time.

Momentum Trading

Momentum trading is a day trading strategy where traders buy stocks that are rising in price and sell stocks that are falling in price. They take advantage of the momentum of the market and try to ride the trend as long as possible.

For example, if a stock is trading at $50 and has been consistently rising over the past few hours, a momentum trader may buy the stock and sell it when the momentum starts to fade. This strategy can be risky because momentum can shift quickly, but with the right analysis and risk management, it can be profitable.

Range Trading

Range trading is a day trading strategy where traders buy stocks when they're at the bottom of a price range and sell them when they're at the top of the range. Traders use technical analysis to identify price ranges and look for stocks that are likely to move within those ranges.

For example, if a stock is trading between $50 and $60, a range trader may buy the stock when it's at $50 and sell it when it's at $60. This strategy can be less risky than other day trading strategies because traders are taking advantage of established price ranges.

News Trading

News trading is a day trading strategy where traders buy or sell stocks based on news events. Traders monitor news sources to identify events that could affect the stock market and make trades accordingly. For example, if a company announces a positive earnings report, a news trader may buy the stock and sell it when the market reacts to the news. This strategy can be risky because news events can be unpredictable, but with the right analysis, it can be profitable.

In conclusion, day trading can be a lucrative venture for those who are willing to put in the time and effort to learn the day trading strategies and tools. Scalping, momentum trading, range trading, and news trading are just a few of the day trading strategies available to traders.

It's important to remember that day trading involves risk, and traders should have a solid understanding of risk management before starting. With practice and experience, day trading can be a rewarding and exciting way to invest in the stock market.

How to Day Trade in Canada

The portrayal of day trading often suggests that it can lead to a lavish lifestyle, regardless of where the trader is located in the world.

In reality, day trading is much more difficult to do, especially when you consider all of the aspects involved with the risks.

Statistics to keep you in line with reality:

- 80% of all day traders quit within the first two years.

- Average retail investors underperform a market index by roughly 1.5%. Active traders underperform by 6.5% annually.

- Roughly 1% of day traders have some consistency in being profitable net of trading fees.

If you are still adamant about learning how to day trade in Canada and are hoping to make money in day trading here are the steps.

1. Plan Your Approach

If you are considering day trading as a full-time career, there are several key points to consider. The majority of your work will be done during regular market hours if you plan to day trade stocks, but if you want to trade other investments, such as futures, your work window may be wider.

Day trading as a sole source of income is a high-risk venture, especially for beginners. We recommend setting aside money in an emergency fund and having enough liquidity to cover basic expenses for at least the first year.

Day trading as a full-time career requires a high risk tolerance and the ability to make decisions without being influenced by emotions. If you lack these characteristics, day trading will be challenging or even impossible, whether as a career or a hobby.

Lastly, you need to consider your day trading infrastructure, which includes modeling software, computer hardware, and data sources.

Without a full-time commitment to day trading, it is virtually impossible to achieve long-term success. You are competing with professional traders, career day traders, institutions, asset managers, and many other players in the open market.

Taking into account the costs of day trading and the level of competition, treating day trading as a hobby is akin to gambling, and we do not recommend day trading unless you are willing to dedicate yourself to it on a full-time basis.

2. Choose the Right Brokerage Account

Day trading can become more complicated when you factor in taxes. While tax-exempt and tax-deferred accounts may seem attractive, it's best to trade within a regular non-registered investment account to avoid tax troubles, especially if you're day trading full-time to replace a job or career.

When selecting a brokerage account, look for a discount brokerage that suits your day trading needs. Key factors to consider include low commissions per trade, live price reporting, and the complexity of the trading platform.

We recommend opening a non-registered account with either Questrade or Interactive Brokers. Questrade is beginner-friendly, which can make life easier for new day traders. Interactive Brokers is geared towards more experienced investors and traders and is worth considering after you have become comfortable with trading.

3. Develop Solid Strategy

Once you have established your trading account, it's time to come up with a solid strategy that will help you make money.

The most basic principle of trading or investing is to buy low and sell high to keep the difference as profit. Stocks are the most straightforward type of investment to buy and sell as a day trader.

However, more experienced traders may consider other asset classes like futures, options, and commodities, which come with more risk, particularly when there is leverage involved. Day trading and leverage can be extremely risky and may lead to financial ruin if not done correctly.

Establishing and sticking to a stop-loss strategy is crucial to control losses when day trading. You will encounter many wins and losses, but the goal is to have slightly more winners than losers. Loss aversion is a common emotional bias that can impact your investment performance.

It leads to selling winning positions early and holding on to losing positions for too long. A set rule for stop-loss orders will help quantify and control your losses. However, keep in mind that stop-loss orders don't guarantee that your losing position will be closed out at the established price 100% of the time.

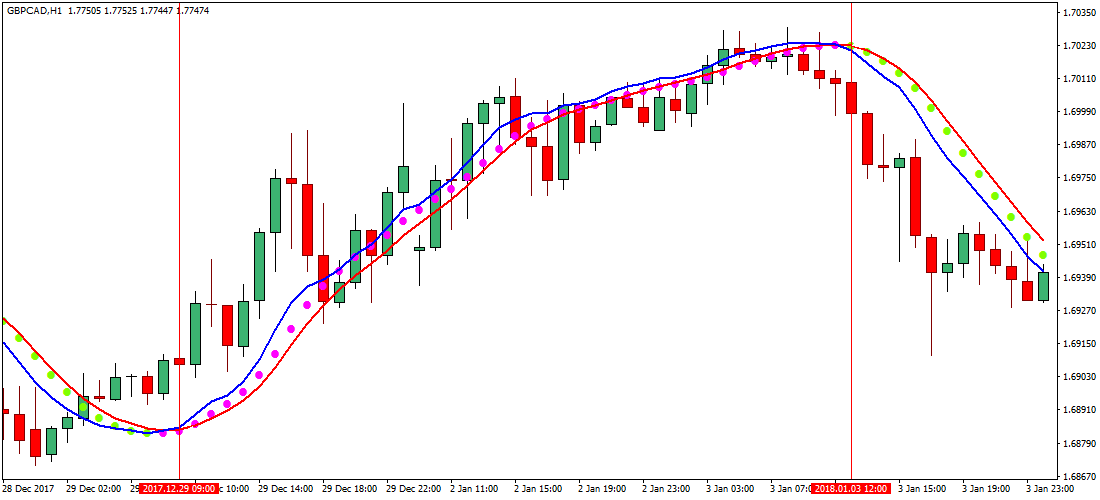

Day traders rely heavily on technical indicators to determine when to enter or exit a trade. Some of the most common technical indicators include moving averages, moving average convergence divergence ( MACD Indicator), relative strength index (RSI), and volume. Observing one or more of these indicators may signal a buying or selling opportunity.

For instance, if the 50-day moving average of a stock breaks above the stock's 200-day moving average, this may be a buying opportunity. This indicates positive short-term momentum in a stock and is known as a golden cross.

Conversely, if the 50-day moving average of a stock breaks below the stock's 200-day moving average, this may signal negative short-term momentum in a stock and is known as a death cross. Creating a formal trading plan that involves multiple technical indicators is an excellent approach to achieve sustained trading success.

4. Trade Execution

Now that you have established a strategy and found investments to trade, it's time to execute the trades. Before placing any trades, consider the cost of the trade, including the number of shares, bid-ask spread, and urgency of the trade.

Stocks with a wide bid-ask spread may not be suitable for day trading because you can lose a significant amount of money to the spread twice - once when you open the position and again when you close it.

There are two main types of trades used to open and close positions:

Market Orders

Market orders immediately execute the trade at the current available price.

Although it gives you control over when a trade is executed, you have no control over the price of execution. For large orders, you may end up buying or selling a large portion of shares at a price different from the current bid or ask price. This trade order is appropriate for urgent information.

Limit Orders

Limit orders control the price that an investment is bought or sold at but give up control of when the trade is executed. If you need to trade quickly based on urgent information, this type of trade order may not be appropriate.

You won't always be filled at exactly the limit price that you input, but brokerages will fill your order at a better price if possible. This means filling your limit buy at a lower price or filling your limit sell at a higher price.

5. Keep a Trading Journal and Refine Your Approach

Successful day trading requires a long-term profitable approach, and it's easy to think you've got it figured out after a few lucky trades. However, to refine your approach and maintain success, you must keep track of every trade you make and analyze what works and what doesn't.

When journaling your trades, keep track of the following details:

- The investment traded

- The indicators used

- The time the investment was bought and sold

- The type of trade used

- The gain or loss as a percentage

- The objective is to have a winning rate of roughly 60%, although this can vary based on the size of your trades, tax situation, and trading commissions paid to your brokerage.

Keeping a trading journal also keeps you accountable and helps you stick to your plan. By analyzing your trades, you can identify flaws in your approach and make the necessary adjustments to refine your strategy.

Day Trading Rules in Canada

Day trading refers to the practice of purchasing and selling securities, such as stocks, within the same day, often multiple times. The Canadian government has established regulations that govern day trading, including day trading rules and guidelines for reporting gains and losses for tax purposes.

Taxes

When it comes to day trading profits in Canada, they are classified as business income and are subject to taxation. On the other hand, losses can be deducted, so day traders can use them to lower the amount of taxes they need to pay.

Canada Banks reports that government tax inspectors evaluate the performance of day traders by examining their behavior and intentions and categorize it as per capita growth or income from trading.

Assigned Security Accounts

In Canada, day traders may hold both short-term and long-term investments, with retirement accounts commonly consisting of the latter. As securities in retirement accounts are typically traded less frequently than equity transactions, Canada mandates the creation of separate accounts to hold different types of securities to ensure that activities related to each account are conducted separately for tax purposes.

No Margin Requirements

In contrast to the United States, Canada has less stringent margin requirements for day trading. In the US, day traders must meet a $25,000 margin requirement, whereas in Canada there are no stock limits for intraday traders.

FINRA investors define a "pattern day trader" in the US as someone who makes four or more same-day trades within five business days, representing more than 6 percent of their total trading activity during that period. If the day trader's account equity falls below $25,000, they cannot participate in transactions until it reaches the required limit.

To Sum Up

Day trading is one of those things that isn’t a fit for everyone but if you have an interest in personal finance and investing it may be something to look into. Make sure you start small to verify your interest and learn the different strategies and markets.

Practice with small investments before investing into large ones and gain some capital before making day trading your main source of income.

These little precautions can help maximize your income from day trading and limit your risk of loss. Even if day trading isn’t the best option for you, that doesn’t mean you can’t enter the investment market. A lot of these markets are great for investing at a small scale to earn some extra money.

In this article, we've provided an overview of day trading in Canada, including the different strategies that can be used and the risks involved. So, if you want to try your newly acquired knowledge, you can choose one of the companies from Canadian stocks list and test day trading strategies.