- Education

- Forex Trading Strategies

- Trading Styles Strategies

- Pair Trading Strategy

Spread / Pair Trading Strategy

KEY TAKEAWAYS

- The stocks in a pairs trade must have a high positive correlation, which is the driving force behind the Pair Trading Strategy.

- Calendar Spread Options goal is to profit from a neutral or directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction.

- Calendar spreads allow traders to construct a trade that minimizes the effects of time.

- The calendar spread is most profitable when the underlying does not make any big moves in either direction till the expiration of the next month of the option.

Pair Trading Strategy

Pair trading is a trading strategy that involves matching a long position with a short position in two stocks with high correlation. Strategy is based on the historical correlation of two stocks. The stocks in a pairs trade must have a high positive correlation, which is the driving force behind the strategy’s profits.

The pair trading strategy is best used when a trader detects a correlation divergence. Based on the historical belief that two securities will maintain a certain correlation, should be used when correlation falters. Profits are possible when underperforming stock regains value and the price of a higher quality security falls. The net profit is the total gained from the two positions.

Pairs trading strategy works with stocks as well as with currencies, commodities and even options.

What is Spread Trading

Spread Trading is the act of purchasing one security and selling another related security as a unit. Spread trades are usually used with options or futures contracts, to get an overall net trade with a positive value called the spread. Spread Trading is done in pairs which eliminates execution risk.

Benefits of Spread Trading

- Offers a lower risk opportunity.

- When choosing trades carefully and monitoring them continually, the probability of collecting the full premium at expiration is high.

- Trades usually last 6 – 21 days, which means, capital is continually working for a trader.

- Spread trading provides opportunities for steady income.

- It’s a perfect strategy to use when the market is volatile.

Disadvantage of Spread Trading

- Lower profits.

Types of Spread Trades

There are a few types of spread trades:

- Intracommodity (Calendar) spreads - is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. These individual purchases, known as the legs* of the spread, vary only in expiration date; they are based on the same underlying market and strike price.

- Intercommodity spreads - These spreads are formed from two distinct but related commodities, reflecting the economic relationship between them.

- Option spreads - are formed with different option contracts on the same underlying stock or commodity.

- IRS (Interest rate swap) spreads - are formed with legs* in different currencies but the same or similar maturities.

* Each transaction at spread trading is called a leg.

What is Calendar Spread Options

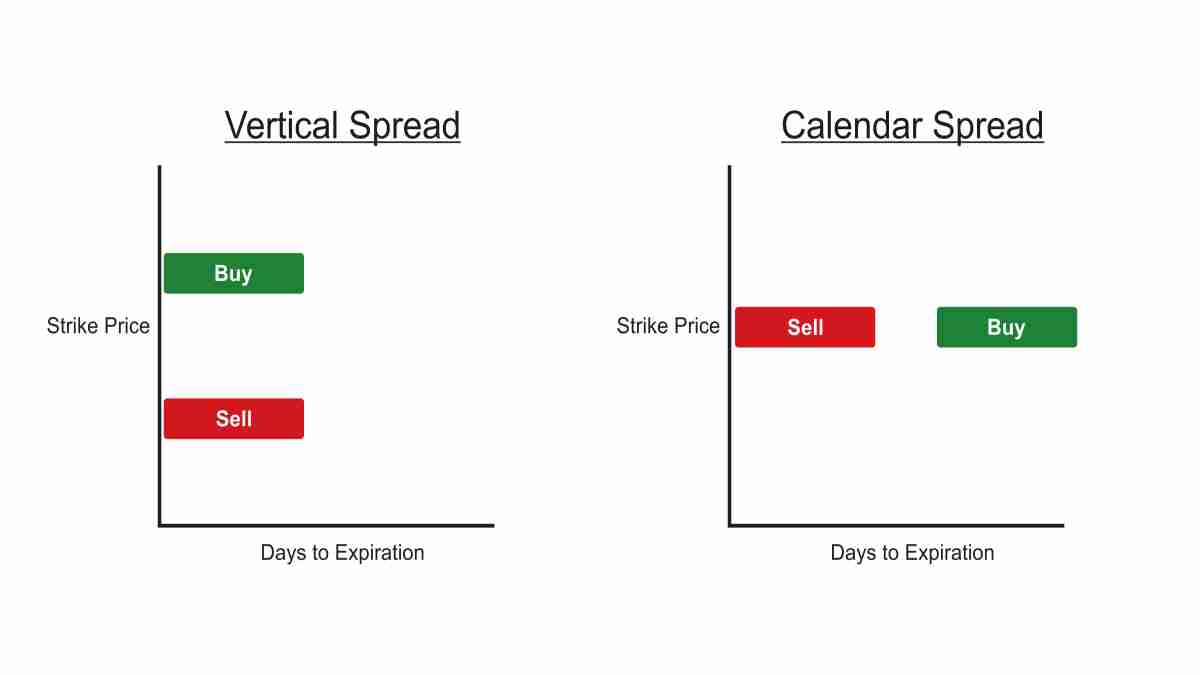

The calendar spread is an options strategy that consists of buying and selling two options of the same type and strike price, but different expiration cycles.

There are Vertical and Diagonal spreads.

Calendar spread is an option or futures strategy that occurs by simultaneously opening a long and a short position on the same underlying asset, but with different delivery dates. In a typical calendar spread, trader would buy a longer-term contract and go short a nearer-term option with the same strike price. If two different strike prices are used for each month, it is known as a diagonal spread.

The typical calendar spread trade involves the sale of an option (either a call or put) with a near-term expiration date and the simultaneous purchase of an option (call or put) with a longer-term expiration. Both options are of the same type and typically use the same strike price. And there is a reverse calendar spread - where a trader takes the opposite position; buying a short-term option and selling a longer-term option on the same underlying security.

To sum up in technical terms, the calendar spread provides the opportunity to trade horizontal volatility skew - different levels of volatility at two points in time - and take advantage of the accelerating rate of time decay, while also limiting exposure to the sensitivity of an option's price to the underlying asset. The horizontal skew is the difference of implied volatility levels between various expiration dates.

Calendar Spread Options Example

Hypothetically, AmerisourceBergen Corp. ABC stock is trading at $73.05 in mid-April, trader can enter into the following calendar spread:

Sell the Jun 73 call for $0.87 ($87 for one contract)

Buy the July 73 call for $1.02 ($102 for one contract)

The net cost (debit) of the spread is thus (1.02 - 0.87) $0.15 (or $15 for one spread).

This calendar spread will pay off the most if ABC shares remain relatively flat until the Jun options expire, allowing the trader to collect the premium for the option that was sold. Then, if the stock moves upward between then and July expiry, the second leg will profit.

The ideal market move for profit would be for the price to become more volatile in the near term, but to generally rise, closing just below 85 as of the Jun expiration. This allows the Jun option contract to expire worthless and still allow the trader to profit from upward moves up until the July expiration.

PRACTICE MAKES PERFECT

The Bottom Line on Pair Trading Strategy

The market is full of ups and downs that can kick unprepared weak players. Fortunately, using market-neutral strategies like the pairs trade, investors and traders can find profits in all market conditions. The appealing part of Pairs trade strategy is in its simplicity.