- Education

- Canadian Stocks List

- Canadian Tire Corporation Stock

Canadian Tire Corporation Stock

Are you considering investing in Canadian Tire Corporation stock?

In this article we will analyze and provide everything you need to know. We'll explore Canadian Tire Corporation’s brand strength, recent performance, technical indicators, financial health, and future outlook.

KEY TAKEAWAYS

- Canadian Tire has a strong brand presence and a well-established reputation in Canada.

- The stock has seen a decline in profitability, with a net loss in Q4 2023 compared to the previous year.

- Indicators suggest a mixed outlook, with both bearish and bullish signals. The price action in the near future will be crucial.

- While the company offers a healthy dividend yield, a high debt-to-equity ratio raises concerns. Recent earnings decline is another point of caution.

- Analysts are divided on CTC, with uncertainty surrounding future performance. The success of growth plans and the overall economic climate will play a significant role.

About the Canadian Tire Corporation Stock

Canadian Tire Corporation, or Canadian Tire as it's commonly known, is a large Canadian retailer with a presence across the country. They operate various retail formats including:

- Canadian Tire: Stores offering a wide variety of general merchandise, including automotive parts, sporting goods, tools, and household items.

- Sport Chek: Specializes in sporting goods and apparel.

- Goal: Focuses on men's and women's apparel and footwear.

- PartSource: Sells auto parts and accessories.

- Canadian Tire Financial Services: Provides financial products and services like credit cards and loyalty programs.

Canadian Tire is a dominant player in the Canadian retail landscape, particularly for general merchandise. Here's how they stack up:

- Brand Recognition: Canadian Tire is a well-established brand with a strong reputation for quality and value.

- Market Share: Holds a significant share of the Canadian retail market, especially in sporting goods and automotive parts.

- Retail Footprint: Extensive network of stores across Canada, making them accessible to a wide range of customers.

CFD Trading in Canada and CTC Stock

CFD trading in Canada is a leveraged product that allows speculation on the price movement of an underlying asset, like a stock. With CFDs, you can speculate on whether the CTCa stock price will go up or down, allowing for potential profit in either scenario. Also use leverage - CFDs are leveraged, meaning you can control a larger position with a smaller initial investment. This magnifies both potential gains and losses.

- Stock price: As of April 10, 2024, the closing price for CTC.A (Class A shares) was $130.76 CAD.

- Recent performance: The stock price has been relatively stable recently, with a low daily volatility of 3% . However, it is down from its 52-week high of $189.82.

- Company news: Canadian Tire recently reported challenging Q4 results due to economic headwinds.

Overall, Canadian Tire is in the consumer cyclical sector. While the stock has underperformed the market recently, it has a history of stable share price.

CTCa Stock Price

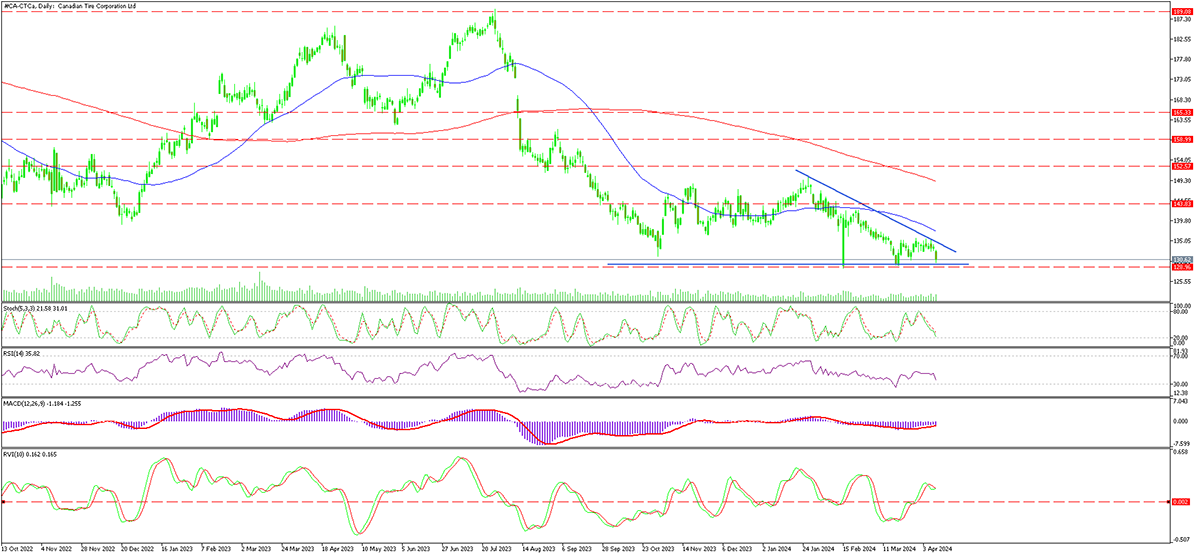

The technical analysis of Canadian Tire Corporation (CTC) on a daily timeframe shows several bearish indicators with some bullish hints.

- Moving Averages: The 50-day moving average (MA) is below the 200-day MA, which is a sign of a downtrend. The price is also currently below the 50-day MA, indicating short-term bearishness.

- Support Level: The horizontal line at $128.9 is acting as a support level, but the price has been testing this level recently. If the price breaks below this level, it could signal further downside potential.

- Descending Triangle: The downward sloping trendline and the horizontal support line are forming a descending triangle pattern. This pattern is typically seen as a bearish continuation pattern, suggesting that the price could break down below the support level.

However, there are also some signs that the bearish trend may be losing momentum:

- RSI and Stochastic: Both the RSI and Stochastic indicators are near the oversold zone. This suggests that the stock may be oversold in the short term and due for a bounce.

- RVI: The Relative Volatility Index (RVI) is above 0, which suggests that there is still some volatility in the stock. This could be a sign that the downtrend is not yet over, but it could also be a sign that there is potential for a reversal.

- MACD: The MACD (Moving Average Convergence Divergence) indicator is near 0, but it is below the signal line. This is a neutral signal, but it suggests that the downward momentum may be starting to wane.

Overall, the technical analysis of CTC stock price is mixed. There are both bearish and bullish indicators. The price action in the near future will likely determine whether the stock breaks down below the support level or bounces back up.

You can also checkout Canadian Tire Stock price history to better understand the whole picture.

Canadian Tire Corporation Stock Trading

While Canadian Tire has a healthy dividend yield and a long history, recent financial performance shows some cause for concern. Here, let’s see:

- Market Capitalization: At 7.68 Billion CAD, CTC has a decent market size.

- Debt: This is a weak spot. CTC has a high debt-to-equity ratio (around 144%), meaning it relies heavily on borrowed money. This can be risky if economic conditions worsen.

- Profitability: Here's a concerning trend. Price-to-Earnings Ratio (P/E) of 62.10 is quite high, indicating the stock price might be inflated compared to recent earnings. This is supported by their recent Basic EPS (Earnings Per Share) of 3.81 CAD, which is down significantly year-over-year.

- Dividend Yield: The 2.81% dividend yield is attractive for income investors, indicating a stable portion of profits returned to shareholders.

Positive Signs

- Dividend Yield: The 2.81% dividend yield is attractive for income investors seeking regular payouts.

- Interest Coverage: While debt is high, the interest coverage ratio (around 4x) suggests CTC can currently cover its interest payments with earnings.

Areas of Caution

- Recent Earnings: Canadian Tire reported a net loss in Q3 2023 compared to a net income the previous year. This suggests a decline in profitability.

- Debt: A high ratio indicates significant debt burden, potentially impacting future growth and financial stability.

Overall, Canadian Tire has a strong brand presence and history, but recent financial performance suggests some challenges. Their high debt level and declining earnings could be cause for concern.

So what we have is that the company reported a disappointing Q4 with a net loss compared to a net income the previous year, which reflects a decline in profitability. Lower sales, full-year 2023 retail comparable sales finished down 2.9% compared to 2022. Consumer confidence has been impacted by economic factors, leading to lower demand for Canadian Tire's products.

The Future Outlook is

- Analyst Ratings: Analysts are currently divided on CTC, with an average recommendation of "Hold". The price target estimates range significantly, reflecting the uncertainty about the future.

- Growth Plans: Canadian Tire is investing in upgrading stores, online businesses, and private-label brands, which could lead to future growth. However, the success of these plans remains to be seen.

- Economic Factors: The overall economic climate will play a big role in Canadian Tire's future performance. Consumer spending habits will likely be impacted by factors like inflation and interest rates.

Overall, Canadian Tire's future outlook is uncertain, as company faces challenges but also has potential growth opportunities.

If you are interested in trading Canadian stocks, you'll need to consider Canadian stock market hours – they typically run from 9:30 AM to 4:00 PM Eastern Time. To get started, download MetaTrader 5, a popular trading platform, and explore the Canadian stock options available during those trading hours.

Bottom Line on Canadian Tire Corporation Stock

Canadian Tire Corporation presents a complex picture for investors. While it has a strong brand and history, recent financial performance and high debt raise concerns. The future outlook is uncertain, with both potential growth opportunities and economic challenges on the horizon. Carefully consider all the information presented before making any investment decisions about CTC stock.