- Education

- About Forex

- What is Forex Trading and How does it Work

What is Forex Trading and How does it Work

What is Forex

Forex is a decentralized global market where all the world's currencies are traded against each other, and traders make a profit or loss from the currencies’ value changes. Forex Market is also known as Foreign Exchange Market, FX or Currency Trading Market.

Many novice traders have problems understanding what Forex is and how it works, and they are followed by quite a rational question - is Forex trading worth it?

Of course, beginners are often prone to mistakes such as unrealistic goals, greed, inappropriate haste and lack of knowledge - these are the main reasons that many of those who try to start a career in trading are disappointed and leave empty-handed. Before doing anything, it is extremely important to understand what is behind the Forex market and how it works.

Let's start from the very beginning.

Table of Content

- What is Forex Trading

- How does Forex Trading Work

- What is Forex Market

- How to Trade Forex

- History of Forex Market

- Gold Standard and Bretton Woods Systems

- Forex Market Hours

- Participants of Foreign Exchange Market

KEY TAKEAWAYS

- The value of a currency is measured by how much another currency can be bought with one unit of it. This is called a price quote.

- Usually there are no problems when trading on Forex, and there is more than enough liquidity.

- The purchasing power of the average trader is usually very small compared to higher level traders that they need a Forex broker or bank to provide a trading account, financial leverage and access to the market via trading servers.

What is Forex Trading

Forex trading essence can be explained like this - the value of a currency is measured by how much another currency can be bought with one unit of it. This is called a price quote. A quote always consists of two prices - bid (bid or ask price) and ask (ask or offer price). You buy currency at the ask price, and when you sell it, at the ask price.

Later in your educational curve you can learn What is Cryptocurrency as well. But if you are interested, we welcome you to jump start now.

I want to note that the offer price of any financial instrument is always higher than the ask price.

The bank will always buy your currency a little cheaper and sell it to you at a higher rate. The spread is the difference between the bid and ask price, which is the commission you pay to a broker for providing services.

Bid and ask prices are available to market participants at any time, except when the market is closed. The trader receives quotes via the Internet from the broker who provided him with a trading account. In turn, the brokerage firm receives price quotes from its liquidity providers, i.e. banks.

Generally speaking, the more liquid the market, the smaller the spread. Usually there are no problems when trading on Forex, and there is more than enough liquidity. However, there are times, for example during the release of important news, when there are gaps (price gaps) due to strong price changes over very short periods of time.

The rest is simple mechanics.

How does Forex Trading Work

So, how does the foreign exchange market work is a question that every beginner should know the answer to.

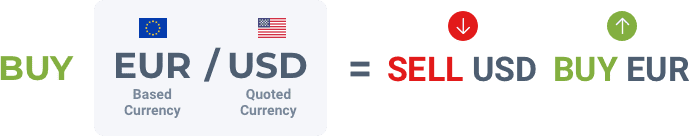

Trading in the foreign exchange market takes place by clicking on the trading platform that the trader choosed. When an order is placed to buy the EUR/USD currency pair, part of the funds from the trader's account is used to buy the base currency of the EUR/USD pair, in this case, the euro, and sell the quote currency (US dollars).

The order is placed either with a broker or directly displayed on the interbank Forex market, where there are large players.

Depending on the trading strategy, the trader waits for the owned currency to rise in price and sell it. When the trader is satisfied with the profit, he closes the order, and the broker does the opposite, meaning - sells euros and buys dollars. When a trader places a sell order, the opposite process occurs.

It is important to understand that a trader can place an order to sell and buy currency that he does not own. Which is called CFD Trading.

The concepts of buying and selling in Forex can be confusing at first, because in each transaction one currency is exchanged for another, which means that each transaction is both a "buy" and a "sell" of a currency. Later in your education you will get to know about pips, but if you are interested, can learn it now from "What is Pip in Forex" article.

What is Forex Market

So, what is the Forex market and what is the function of the foreign exchange market? Let's dive in.

Forex (foreign exchange market) is an international over-the-counter foreign exchange market in which market participants trade by buying and selling currency pairs.

Let's talk a little about the Forex market participants:

The Forex market is mainly dominated by large national banks, multinational companies, and hedge funds whose trading decisions significantly impact currency prices. On the other hand, medium-sized companies, private investors, and those who require hedging services rely on private banks. Financial brokers, smaller banks, and investors are among the smaller market participants.

Most of the significant market participants have direct access to the interbank Forex market, where currency exchange transactions occur without intermediaries. This privilege is granted to those with a considerable amount of funds that exceed a specific threshold.

Retail Forex traders make up the smallest market players. Compared to higher-level traders, they typically have limited purchasing power and require a forex broker or bank to provide trading accounts, financial leverage, and access to the market through trading servers.

Video on What is Forex Market

How to Trade Forex

Now that you know basic concepts let’s move on to the next steps.

1. Select a currency pair

When trading forex you will always buy one currency while selling another at the same time. Because of this, you will always trade currencies in a pair. Most new traders will start out by trading the most commonly offered pairs of major currencies, but you can trade any currency pair that is available on the trading platform as long as you have enough money in your account.

2. Analyze the market

Research and analysis is the foundation of trading endeavors. During researching, you’ll find great amount of forex resources, which is overwhelming at first. But as you research a particular currency pair, you’ll find valuable resources that stand out from the rest.

3. Read the quote

You’ll see two prices shown for currency pairs (picture showing base and quote currency). The first rate is the price at which you can sell the currency pair and the second rate is the price at which you can buy the currency pair. Difference between the two rates is called the spread. You can view our live spreads.

4. Pick your position

In Forex trading you can speculate the currency on up and down movements in the market.

- With a buy position you believe that the value of the base currency will rise compared to the quote currency. For example if you are buying EUR/USD, you believe the price of the euro will strengthen against the dollar.

- With a sell position you believe that the value of the base currency will fall compared to the quote currency. For example if you’re selling EUR/USD, you believe the price of the euro will weaken against the dollar.

History of Forex Market

The history of Forex market is marked by two particular events which put a deep stamp on its formation and development. These two historical events are the creation of Gold Standard System and Bretton Woods System.

Gold Standard and Bretton Woods Systems

Gold Standard System was formed in 1875. The main idea behind it was that governments guaranteed that a currency would be backed by gold. All the major economic countries defined an amount of currency to an ounce of gold as the value of their currencies in terms of gold and the ratios for these amounts became the exchange rates for these currencies. This marked the first standardized means of currency exchange in history. However, World War I caused a breakdown of the gold standard system as countries sought to pursue economic policies which would not be constrained by the fixed exchange rate system of the Gold Standard.

In July 1944 more than 700 representatives from the Allied nations brought forward the importance of a monetary system which would fill the gap left behind the gold standard. They arranged a meeting at Bretton Woods, New Hampshire, to set up a system that would be called the Bretton Woods system of international monetary management. The creation of Bretton Woods System led to the formation of fixed exchange rates as the United States defined the value of US dollar in terms of gold equal to $ 35 for one ounce and other countries pegged their currencies to the dollar. The US dollar became the main reserve currency and the only currency that was backed by gold. However, in 1970 the U.S. gold reserves were so depleted that it was impossible for the U.S. treasury to cover all the reserves held by foreign central banks.

In August 1971 the U.S. announced it would no longer exchange gold for the U.S. dollars that foreign central banks had in reserve .This was the end of Bretton Woods System and the beginning of Forex Trading System.

Forex Market Hours

The currency exchange market never sleeps, and the quotes constantly change. This is the only market open around the clock five days a week. Large volumes of currencies are traded on the international interbank market in Zurich, Hong Kong, New York, Tokyo, Frankfurt, London, Sydney, Paris and other global financial centers. This means that the interbank market is always open - when the working day ends in one part of the world, banks in the other hemisphere have already opened their doors and the trade goes on.

No time frames - a very important condition for traders with a busy working schedule. They do not need to worry about opening and closing hours of trading sessions on the interbank market and are free to arrange their trade anytime they

want, since it does not matter for Forex traders which bank provides liquidity for their transactions.

But the Forex market liquidity can change during the day, depending on which time zone banks are operating at the moment (when liquidity falls, spreads grow and the speed of price changes slows down). For example, the pairs with the

Japanese yen will be the most liquid during the working time of Japanese banks.

Below you can find the opening and closing hours of trading sessions on the interbank market (i.e. periods of high liquidity), determined by the opening hours of the largest banks in each time zone.

Sydney

Tokyo

London

New York

- Sydney 7:00 PM - 4:00 PM (CET)

- Tokyo 7:00 PM - 4:00 PM (CET)

- London 3:00 AM - 12:00 PM (CET)

- New York 8:00 AM - 5:00 PM (CET)

Participants of Foreign Exchange Market

Foreign exchange market is composed of different participants, also called Forex market players, who trade on the market for quite various reasons. This means that participating in Forex market transactions does not take place simply for speculative purpose. Each of the participants plays its own role in the market providing the latter’s wholeness and stability.

The main players of the market are

- Governments and Central Banks

- Commercial banks and companies

- Hedge funds

- Brokerage companies

- Investors

- Retail Forex traders

- Speculators

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.

Was this article helpful?

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center Register with IFC Markets Now

Global Access to Financial Markets from a Single Account